In this post, let us rise into the air to have a good view of the stock market. From this vantage point, seemingly unrelated things all of a sudden become connected and patterns hidden by all the buzz and noise start to appear!

If you want to understand the big picture of technical and fundamental analysis, its relation to the payoffs of certain option strategies, and what this has to do with buy-and-hold, read on!

The financial markets are a playground for diverse strategies, each with its own unique perspective and methodology. Among these, technical and fundamental analysis stand out as two distinct yet profoundly interrelated approaches. By digging deeper, we find that these two techniques, though appearing different on the surface, are two sides of the same coin, creating a fascinating interplay that leads to a classic investment strategy: buy-and-hold.

Parts of this post were written with the help of ChatGPT-4, concept and ideas are my own. The payoff diagrams were created with R, you can find the code here: Financial X-Rays: Dissect any Price Series with a simple Payoff Diagram.

The Yin and Yang of Investing: Technical and Fundamental Trading

First, let’s uncover the essence of these two approaches. On one side, we have technical analysis, which involves studying price movements and market trends. Technical traders rely on charts and various statistical measures to determine points of entry and exit in the market. They believe in the power of momentum, buying when prices rise and selling when they fall, under the premise that what goes up will continue to rise, and vice versa. This behaviour tends to make stock price movements in either direction more extreme.

On the other side is fundamental analysis, which seeks to evaluate securities by measuring the intrinsic value of a company. This is done by examining related economic, financial, and other qualitative and quantitative factors. When a stock’s price falls, fundamental traders see an opportunity: they believe the stock is undervalued, and that its price will revert to its fundamental value in the long run. This mean-reverting philosophy creates a stabilizing effect on stock prices.

The aforementioned approaches might seem diametrically opposed, but they are not. Instead, they offer two contrasting lenses through which to view the market. Let’s use an options trading analogy to illustrate this.

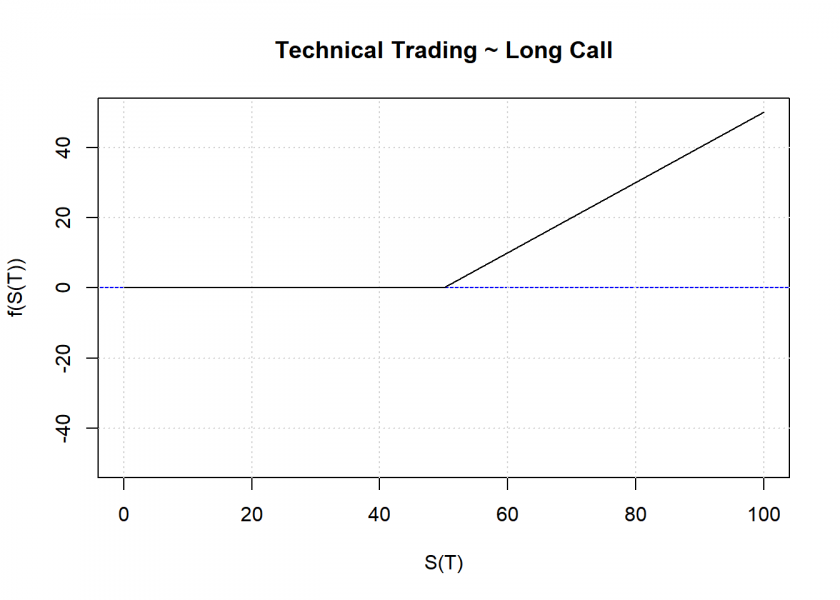

Technical traders can be likened to being long a call option. When you buy a call option, you have the right, but not the obligation, to buy an asset at a predetermined price within a specified period. It’s a bullish strategy, expecting the stock’s price to rise, similar to the momentum-driven philosophy of technical traders. When the stock falls below a certain point technical traders tend to sell illustrated by the flat line on the left, so that they won’t lose any more money, no matter how far the stock falls.

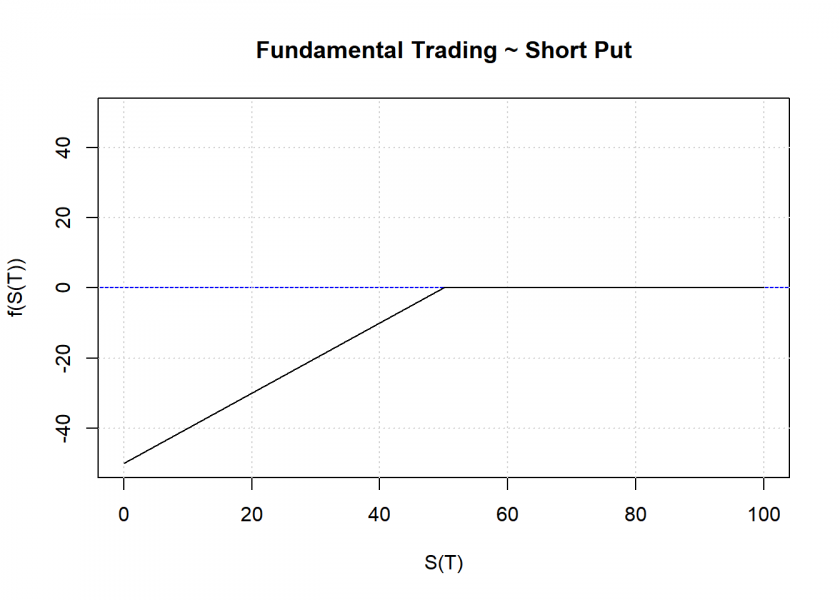

In contrast, fundamental traders can be thought of as being short a put option. When you look at the payoff diagram you see a cap on the right where you stop earning money from a certain point on, no matter how far the stock rises, which boils down to the same effect as selling the stock at that point. This resonates with the belief of fundamental traders that an undervalued stock will return to its fundamental value where they will tend to sell it.

The Symbiosis: Long the Stock

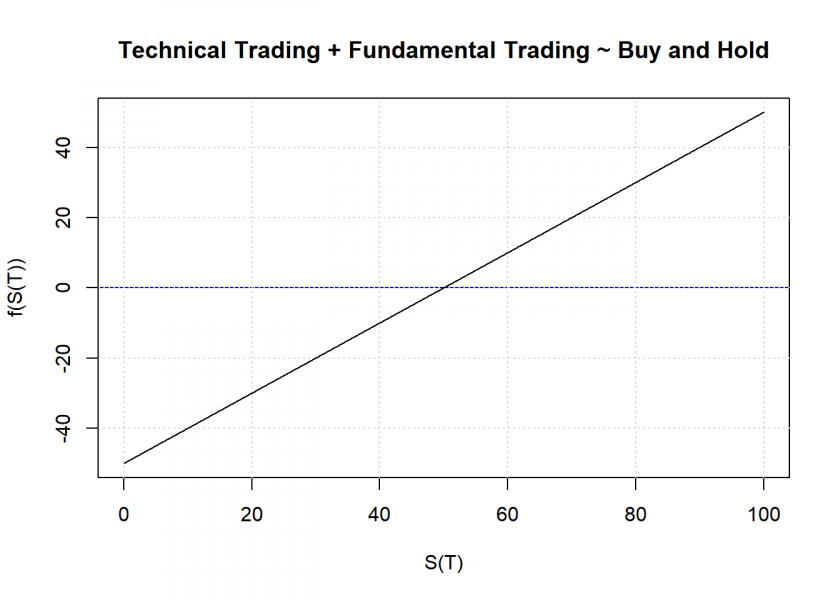

When we combine these two perspectives, an intriguing scenario unfolds.

The combination of long call (representing the technical analysis approach) and short put (symbolizing the fundamental analysis approach) results in being long the stock (something also known as put-call parity in option lingo). This is a situation where the investor owns the stock and will hold it no matter how its price develops — a strategy commonly known as buy-and-hold.

The Synthesis: Technical + Fundamental Trading ~ Buy-and-Hold

This takes us to an interesting conclusion: technical and fundamental analysis can be seen as two integral parts of a holistic investment approach. While technical analysis represents the momentum-driven, trend-following aspect (long call), fundamental analysis brings in the mean-reversion, value-investing perspective (short put). Together, they form the age-old, tried-and-true strategy: buy-and-hold.

So, combining those two active investing approaches is equivalent to passive investing! Which makes sense, when you think about it: when you combine all possible investment strategies you must end up with the market as a whole.

In the next post, we will use these insights to build a full-fledged multi-agent simulation of the stock market with R, so stay tuned!

Addendum: Skewness and Option Premium

This addendum explores the implications of viewing technical trading as replicating a long call option and fundamental trading as its converse. In technical trading, akin to a long call, investors might sell slightly below and buy a bit above the strike price, incurring minor losses during price fluctuations near the strike. This boils down to the old “Cut your losses and let your profits run”. Conversely, fundamental traders tend to systematically gain in these scenarios, basically by, counterintuitively, doing the opposite: “Cut your profits and let your losses run”!

Two key outcomes arise from this analogy:

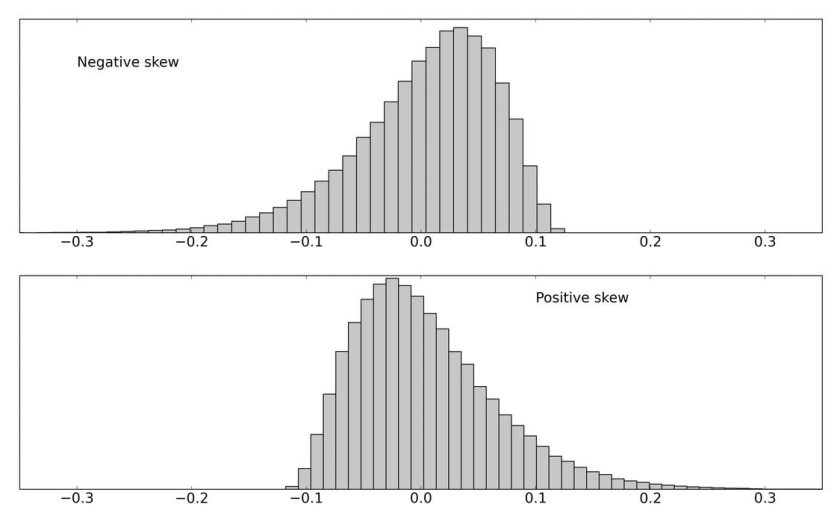

- Skewness of Returns: Technical trading is likely to yield positively skewed returns reflecting gains when the market significantly rises but limiting losses otherwise. In contrast, fundamental trading might exhibit negatively skewed returns, benefiting from regular small gains but risking occasional large downturns.

- Option Premium Analogy: The concept aligns with the mechanics of option premiums. Selling options involves receiving a premium, akin to the small gains of fundamental trading, as compensation for assuming risk. Similarly, buying options, mirrored in technical trading, entails paying a premium (like an insurance premium), in this case, the slight losses during price fluctuations.

One last point: the expected return of each trader in this simplified market with no interest is 0 (zero) but the distribution of those returns is different for both. While the technical trader could make huge gains when the market rises, these are worn off by little losses when the price is wiggling around the fair value (= strike). The situation is just the opposite with fundamental traders, that often constantly earn some “premium” but bear the risk of a huge selloff. These dynamics lead to the respective skews in the returns above.

The problem with negatively skewed trading strategy is that in the event of a huge selloff many traders will lose their nerve and realize the loss. This is one of the reasons so many day traders (about 80%) lose money in the long run, some of them stopping trading for good after such a catastrophic loss (that is not to say that you should hold your investments no matter what! The real world is considerably more complex). Another reason could be margin calls so that the bank liquidates their position and thereby locks the loss in.

In the hedge fund world (oftentimes hugely) negatively skewed trading strategies are sometimes called “picking up nickels in front of a steam roller”, for obvious reasons.

Overall, this perspective integrates characteristics of options theory with trading strategies, highlighting risk-reward dynamics and the subtle costs of market entry and exit strategies.

DISCLAIMER

This post is written on an “as is” basis for educational purposes only and comes without any warranty. The findings and interpretations are exclusively those of the author and are not endorsed by or affiliated with any third party.

In particular, this post provides no investment advice! No responsibility is taken whatsoever if you lose money.

(If you make any money though I would be happy if you would buy me a coffee… that is not too much to ask, is it? 😉 )

UPDATE June 6, 2023

I created a video for this post (in German):

UPDATE August 15, 2023

The follow-up post is now online: Can a Simple Multi-Agent Model Replicate Complex Stock Market Behaviour?

In the 21 st Century no one with a serious financial education considers technical analysis anything other than wishful thinking gibberish, and fundamentals give an indication of future solvency, that is it.

In the era of quantitative finance I think you have missed the boat, I think you had best get out of public libraries and look at some academic papers or hedge funds. Mug retail punters are not really serious traders, nor are so called day traders, most of them, anyway.

Well, I am a well-known quant (see e.g. here: https://quant.stackexchange.com/users/12/vonjd), but thank you for your “advice” anyway 😂

Same with buy and hold great way to possibly match inflation………possibly?

Golly John, you’re a tough cookie. The hardest part of buy and hold is simply hold, and second hardest probably what to buy. Maybe see what can happen: https://seekingalpha.com/article/4523903-buyandhold-2012-grew-4k-to-87-million-advice-for-you